Case Stories

Contently Case Story: How Tangerine Streamlines Approvals and Publishes Breaking News

On a brisk winter morning in Ottawa, Ontario, the Canadian federal government held an official budget release to announce how it would spend tax money for the coming year. The announcement is huge news; it directly impacts the financial outlook for all Canadians.

Even though the release is eagerly anticipated, the budget document, which is several hundred pages, isn’t read by most. The public relies on media outlets and financial commentators to provide high-level analysis that helps everyone understand the budget’s impact. However, to control the timing of when and how the information becomes available, the government embargoes reporters together until the late afternoon.

So for seven hours, a group of 300 journalists waited for access to the document. They sat together in a single room—without their phones—taking notes by hand to craft their stories.

Once the embargo was lifted and mobile devices were returned, reporters from Canada’s largest news outlets, such as the National Post and Toronto Star, submitted their takes. But there was also another journalist working on deadline, this one commissioned by an unlikely financial publisher: Tangerine, Canada’s leading digital bank.

Breaking news without breaking the bank

To cover the Department of Finance’s announcement, Tangerine turned to one of its trusted freelance reporters: Doug Watt. A financial journalist who get his start in 1995, Watt was among the reporters locked in the House of Commons, filing through the thick report to craft a story for the bank’s readers.

“Despite the initial stress and panic, there are so many angles you can choose from,” Watts said. “You just have to figure out what’s right for your audience.” By the time WiFi was restored and electronics were returned, the writers rushed to file their stories. For Watts, that story went to the editorial team at Tangerine.

On the other end was Darin Diehl, director of content and shared services, who described on-the-ground reporting as a great way for Tangerine to “be more intentional” about its editorial content.

“There are occasions, like this one, when we want to react in real time to breaking news,” Diehl explained. “The difficulty is as a financial services company, we’re in a highly regulated industry, and we have multiple stages of review. Whether it’s an article, infographic, a video, or a quiz—we can’t skip those stages.”

While traditional outlets can post news immediately, Tangerine can’t be that fast. To combat the lengthy approval process, Diehl and his team had to devise a plan. “What we do is get the buy-in from all of the legal and compliance folks and anyone on our marketing team that’s part of the collateral review process,” Diehl said. “People are warned in advance.”

Once the concept gets approved and the necessary approvers book time for material review on their calendars, the editorial team moves swiftly.

“We’re able to customize those review chains so we’re sure the right people see it.”

“With news reporting, the workday goes a little bit longer than the normal nine-to-five, but people are prepared for that,” Diehl said. “We’re able to have that story filed, go through all of the stages of editing and approval, and publish in less than a couple of hours. For financial services, that’s lightning fast.”

Contently’s custom workflow helps assist this speedy review process. According to Diehl, the ability to tailor a documented review across multiple departments on a per-story basis is incredibly valuable when managing the company’s blog.

“An investment story requires different reviewers than, say, a story that’s more connected to saving or mortgages or checking,” Diehl said. “With Contently, we’re able to customize those review chains so we’re sure the right people see it.”

In addition to custom review, Tangerine relies on Contently’s editing tool for version control, which keeps a record of changes for every draft and approval. “The review process along with the calendaring tool helps us stay organized,” Diehl said.

Not just a bank website

If you head to Tangerine’s blog Forward Thinking, you won’t find a stodgy financial services website with humdrum explanations and overt self-promotion. Instead, the site—framed with the brand’s signature orange color scheme—takes you to a series of articles, videos, infographics, and quizzes meant to help users become savvier spenders and more thoughtful savers.

While the main focus is on topics related to banking, the stories also tap into the more emotional aspect of money management. For Mother’s Day, the bank posted a roundup of bloggers sharing stories about how their mothers helped shape their views on money.

In the video section, independent financial advisor Preet Banerjee has a series of interactive clips that cover lessons like how to tell the difference between secure and unsecure debt, and ways families can budget for their kids’ education.

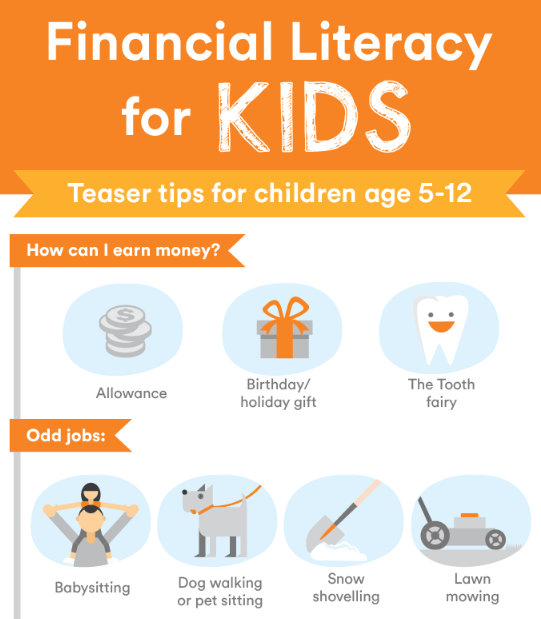

The site also hosts quizzes such as “Do You Have an Old-School or New-School Money Style?” and publishes infographics for all ages, including this one on financial literacy for kids.

Tangerine aims to produce content that educates and engages Canadians, with the end goal of relating financial topics and news back to the digital bank’s services. Part of this utility is ensuring both English and French readers find the material accessible and relevant.

For every story written in English, Tangerine decides whether it makes sense to translate. But the content team doesn’t just translate articles from one language to the other—it goes through a process the French services team refers to as “transcreation.”

“In Canada, we have two official languages, but it’s not just about the language,” Diehl explained. “The province of Quebec, which predominantly speaks French, has a different culture there.”

The French services team translates the story while making alterations to ensure it is culturally sound. Because stories that go through this bilingual process have added layers of production and approval, Tangerine relies on Contently’s calendaring tool to stay on track.

The content-to-sales pipeline

Overall, Tangerine has already seen encouraging results on how the content inspires readers to become customers.

“We’ve found that if that new client’s journey through the website includes the consumption of our content, then the enrollment completion rate is 22 percent higher,” Diehl said. Completion, in this case, is not finishing a story, but enrolling as a bank client or—if you’re already a client—opening a new account.

In 2016, Tangerine decided to dig deeper into the relationship between content and business results, testing how Forward Thinking impacted brand sentiment. Diehl and his team surveyed both subscribers to the blog and non-subscribers to see if there were any noteworthy insights that could show the ROI of content. It turns out that brand perception and sales were 18 percent higher for frequent readers (people who looked at up to four pieces per month).

“We found a delta when it came to brand perception and sales—the actual drivers of trust were higher with frequent readers than with readers, and [the same] from readers to non-readers,” Diehl said.

As the bank moves forward in helping Canadians make smarter decisions with their money, it plans to keep using content as a means to bolster consumer confidence and brand awareness. For Tangerine, the more content can empower citizens, the better.

“Our content marketing is designed to help readers take direct action,” Diehl said. “It’s about teaching people how to do things themselves.”

Get better at your job right now.

Read our monthly newsletter to master content marketing. It’s made for marketers, creators, and everyone in between.