Finance

From Bland to Brand: 5 Best Content Marketing Case Studies in Financial Services

Content related to mortgages, insurance, and financial planning has a way of becoming predictable over time—unless you get a little creative.

In this roundup, we’re diving into the top five financial content marketing case studies that have successfully transformed even the most complex topics into unexpectedly captivating content.

Brown Brothers Harriman

When it comes to financial content, there are two near-universal themes: Most people are on the hunt for more money, and they’re all itching for the secrets of how to get there. But, as all marketers know, when you try to make content that appeals to everyone, you often end up with hollow content that resonates with no one.

For Brown Brothers Harriman, the oldest private bank in America, tapping into the high-net-worth female market wasn’t just a stride towards gender equality in wealth management—it was about seizing an overlooked opportunity.

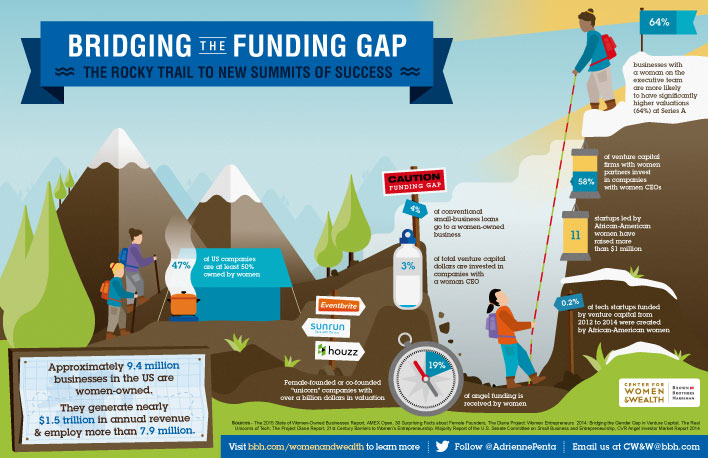

In an effort to break from tradition, BBH started the Center for Women & Wealth, coupled with a pioneering print magazine tailored for these women. They also launched a series of women-centric infographics, such as “Bridging the Funding Gap,” which highlighted the stark funding disparities women entrepreneurs face.

Take these learning lessons from BBH:

- Zero in on a specific audience: It’ll help you create hyper-relevant content that speaks directly to the concerns, aspirations, and realities of your chosen niche.

- Visual storytelling is worth a thousand words: Use it to simplify complex information.

Royal Bank of Canada

Ah, content creation—the challenge at the heart of financial content marketing only mounts when you realize you’re up against not just other financial institutions but also traditional publications, fintech startups, and even TikTok influencers.

So, how do you scale your financial content creation efforts? Royal Bank of Canada had an answer: Get everyone involved.

From the commercial banking team to the wealth management department, RBC tasked all interested divisions to create their own content. Today, RBC’s blog is a vibrant mosaic, offering everything from retirement guidance to educational insights.

Borrow a page from RBC’s playbook by:

- Decentralizing content creation: Empowering finance departments to produce and manage their own financial content fosters a sense of ownership.

- Building a unified yet diverse strategy: While allowing departmental autonomy, all content should still thread together to reinforce your brand’s core message and values.

- Streamlining the review process: Having only one or two key members as reviewers reduces bottlenecks in content production.

BlackRock

Content topics in the finance world can feel pretty daunting to the general public. BlackRock, an investment management corporation, struck content gold with a pivotal insight: People seek out nuanced, humanized narratives.

So they published “How the World Retires,” an interactive report that profiled the retirement journeys of six couples around the globe. Complete with vivid photography, an engaging write-up, and a nifty retirement calculator, the report has outperformed the average BlackRock post by sixfold in engagement metrics.

Draw inspiration from BlackRock by:

- Embracing the human element: The most powerful financial content marketing always has an element of personal connection.

- Demystifying the data: Balancing hard facts and real-life stories can make complex financial concepts more tangible and engaging.

- Exploring interactivity: Whether it’s a calculator, a quiz, a tool, a game, or a poll, interactive content elements can drive audience participation, action, and return engagement.

SoFi

While SoFi’s blogs were initially all SEO- and product-focused, they figured it was time for a revamp. “We had to breathe new life into our content to make it more editorially driven and wired for social distribution,” David Gardner, SoFi’s director of content marketing, explained.

And so, they began telling more intriguing stories that its millennial target audience would care about: debt management, salary navigation, and proactive investments. They even explored longer-form journalistic pieces with member spotlights.

The results? Nothing short of a transformation. The revamped content didn’t just ferry readers to SoFi’s blog; it turned casual browsers into engaged community members who frequently returned for more. SoFi’s organic Google traffic ballooned by 50%, and their overall site traffic increased by a staggering 970%. Meanwhile, total monthly conversions skyrocketed by 247%.

Add these tips from SoFi to your strategy:

- Storytelling is the new currency: Engage your audience with compelling narratives. SoFi’s shift to storytelling, with a personal touch, transformed their financial content from snoozefest to share-worthy.

- Choose the right topics: Don’t just rely on your gut—take the time to dig through engagement analytics, first-party data, and keyword research to understand what your audience is interested in learning more about.

Guardian Life Insurance

Convincing young people to engage with their finances is no easy feat. Bombarded with headlines like “Do you really need that 401(k) for the climate apocalypse?”, they’re not exactly lining up to discuss retirement plans.

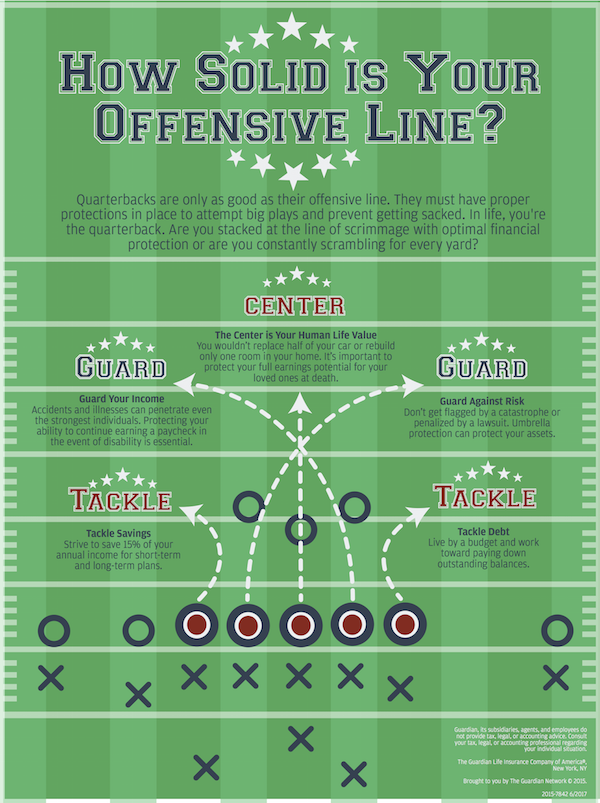

Instead of fearmongering or doling out unrealistic optimism, Guardian Life Insurance launched a series of visually focused, fact-driven visuals to target this demographic. Take, for instance, their “How Solid Is Your Offensive Line?” infographic. By intertwining fantasy football with financial planning, the company translated tedious savings talk into dynamic, scroll-stopping content.

Three key takeaways from Guardian’s strategy:

- Conversions aren’t everything: Engagement metrics like likes, shares, and comments represent the pulse of your audience’s interest and interaction.

- Speak their language: To resonate with younger audiences, strike the right balance between education and entertainment.

- Visual appeal matters: In a world dominated by visual content, use infographics to break down complex financial concepts.

Feeling inspired by these content marketing case studies?

These top financial content marketing case studies remind us that even in an industry often characterized by complex terms and endless data points, there’s room to forge genuine connections through storytelling, visual creativity, and a deep understanding of audience needs.

To succeed as a financial services company in 2024 and beyond, finance marketers must strive to be more than a mere informant. Instead, as these top content marketing case studies demonstrate, try to become a trusted advisor who understands and addresses the underlying financial fears and aspirations of your audience.

Ask The Content Strategist: FAQs

Q: What strategies can financial services companies employ to overcome common hurdles in content creation, such as organizational silos and underfunding?

Educating business execs on the value of collaboration and adopting a more strategic approach to content creation can help decrease organizational silos, while leveraging freelance content creators can increase your team’s bandwidth and help you maintain productivity in the midst of budget constraints.

Q: How has the landscape of financial content marketing evolved in recent years, and what challenges do financial services companies face in this space?

Financial services companies are contending with a digital landscape teeming with influencers, bloggers, and fintech startups, challenging traditional marketing playbooks with compliance, organizational silos, and technological adoption hurdles. Learn more about current trends, challenges, and solutions for finance marketers.

Fuel your inspiration by diving into the best financial services email newsletters and incredible examples of content marketing from banks and the finance industry.

The financial content marketing case studies in this list are Contently clients.

Get better at your job right now.

Read our monthly newsletter to master content marketing. It’s made for marketers, creators, and everyone in between.