ROI

Financial Services Content Report: Industry Benchmarks & 5 Keys to Success

There’s a common misconception that companies in conservative fields like finance, insurance, and healthcare have a harder time creating content. Sure, marketers in these industries deal with more regulations and bureaucracy than someone who works for Red Bull. But these industries also benefit from a key advantage: People crave their expertise.

Money affects everyone. Finances can dictate what we do, where we live, and how we make decisions. It’s a wide umbrella, spanning everything from consumer banking, investment banking, credit cards, fintech, insurance, and more. The fact that many finance organizations try to reach B2C and B2B audiences simultaneously adds another factor to the equation.

Financial services content is also incredibly complicated. Understanding how to pick the right insurance or save for a mortgage can literally change someone’s life. Companies in this space have a unique opportunity to build meaningful relationships with consumers.

To capitalize on that opportunity, finserv companies allocated an average of $23.3 million for their content marketing budgets in 2019, per Contently research. This number includes content creation, distribution, technology, and talent.

Finserv companies are doing a decent job getting a bang for their buck. However, there’s still room for improvement.

To help marketers be more efficient and effective, Contently created this new report that examines the state of financial services content marketing. The first part compares finance against other industries and highlights content benchmarks. The second part explores tips and strategies marketers can use to stand out from their biggest competitors and create content that performs.

Brands spend large sums of money on content marketing. It’s time they made the most of their investments.

[If you prefer to view a PDF version of the report that’s easier to print, we’ve got you covered here.]

Report Methodology

Data for this report was compiled in November 2019. The industry benchmark statistics in the first part of the report came from an internal dataset of 86,270 pieces of content across all industries, measured by Contently’s content marketing platform. Of that sample, 25,544 pieces of content came from financial services companies.

Data in the second part of the report came from StoryBook, Contently’s content strategy tool, which measured top-performing topics, formats, social shares, and more for 2,292 pieces of content from financial services companies.

Key Findings

For visual learners, here’s a high-level breakdown of what we found:

Part I: Financial Services Benchmarks

Competition for attention has never been higher in content marketing. Legacy firms are battling against each other while trying to hold off a surge of new fintech competitors and startups. Consumers, meanwhile, want financial guidance; they’re just not sure who to get it from.

According to the 2019 Edelman Trust Barometer, financial services ranked last out of 15 industries. On a positive note, trust in the industry is on the rise, increasing 8 percentage points since 2014. This means there’s an opportunity for finserv companies to step up and support their customers. Content is a key tool in those efforts.

Financial services vs. all other industries

Recently, finserv companies have made noticeable progress with content performance. In 2018, audiences spent an average of 1:26 seconds with financial services content. A year later, average attention time jumped to 1:51 seconds, which marks a 29 percent increase

Over that same stretch, though, average engagement rate (the percentage of people who spend at least 15 seconds with a piece of content) and finish rate held stagnant. On one hand, the average finish rate in our data set is impressive in comparison to Chartbeat’s scroll depth benchmarks for all content. Brands are creating longer content, but there’s still room to improve the finish rate.

Financial services companies also took strides compared to brands from other industries. Average attention time for all other industries in our data set only moved from 1:32 seconds in 2018 to 1:34 seconds in 2019. However, the other industries like travel, technology, and healthcare boasted a better average engagement rate (70 percent) and finish rate (60 percent) in 2019. Finish rates in fields like travel and tech may be higher because their topics aren’t as technical as those found in finance.

Consumer Finance vs. Institutional Finance vs. Wealth Management

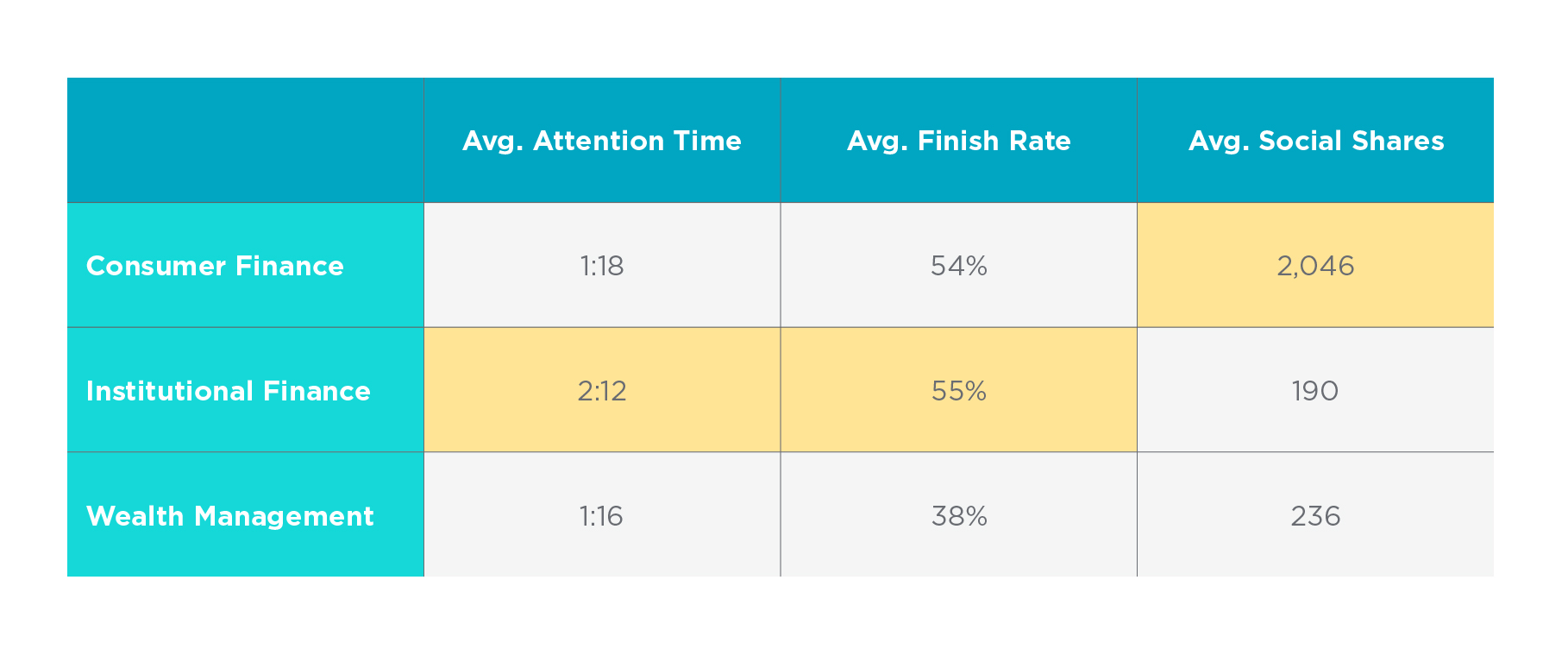

Next, we examined engagement benchmarks for the three of the biggest subcategories in financial services content: consumer finance, institutional finance, and wealth management.

Consumer finance covers personal money tips and financial literacy, like this Bank of America article about getting the most out of your checking account.

Institutional finance content spans B2B coverage about investment banking and global markets, like this Goldman Sachs report on geopolitical risk.

Wealth management concerns individual portfolios and investing, like this Morgan Stanley profile of a female financial advisor’s philosophy.

To compare the effectiveness of the three subcategories, we looked at average attention time, average finish rate, and average social shares.

Consumer finance, unsurprisingly, dominated the social metrics with an average of 2,046 shares per story. When done right, helpful budgeting and saving tips can go semi-viral because they’re more universal than content from the other subcategories.

However, personal finance advice is also a saturated space. It’s harder to stand out with unique advice since many companies recycle the same topics, headlines, and themes. That may explain why average attention time registers at just 1:18 seconds, almost a minute shorter than the average benchmark for institutional finance.

The success of institutional finance content goes to show that B2B marketing doesn’t have to be dry or boring. There’s a real need for that expertise. And generating 190 shares, on average, is very respectable for B2B content of any kind. These numbers suggest that companies cornering the institutional finance beat are finding creative ways to tie their analysis to relevant news and trending topics people care about.

Lastly, we see that wealth management has room for improvement, particularly the 38 percent finish rate. Marketers creating content about wealth management may not need to drive a lot of social shares, since it’s tailored for a niche audience. Yet there’s still an opportunity to create more fluent and accessible content that holds people’s attention and builds trust.

With that in mind, let’s move to the second part of the report and explore ways financial services companies can build better trust and drive more engagement.

Part II: 5 Keys to High-Performing Financial Services Content

The benchmark data raised a few big questions. First, what are the most valuable financial services companies doing to differentiate themselves? Second, what tactics can financial services marketing pick up from them, regardless of budget? And third, what recommendations could we offer to help finance marketers improve in areas they weren’t doing so well?

To answer those questions, we used Contently’s Storybook technology to analyze 2,292 pieces of financial services content from Fortune 500 brands. Here are our biggest takeaways.

- Create social videos and infographics

- Invest in paid distribution on Facebook

- Develop buyer enablement content to drive conversions

- Focus on employee education and advocacy

- Get creative with compliance

1. Create social-friendly videos and infographics

Marketers default to creating written content because it’s easier and cheaper. But brands that rely on churning out generic blog posts are failing to give people what they want: visual content.

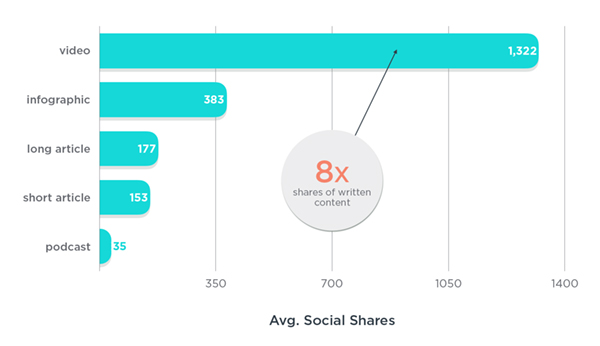

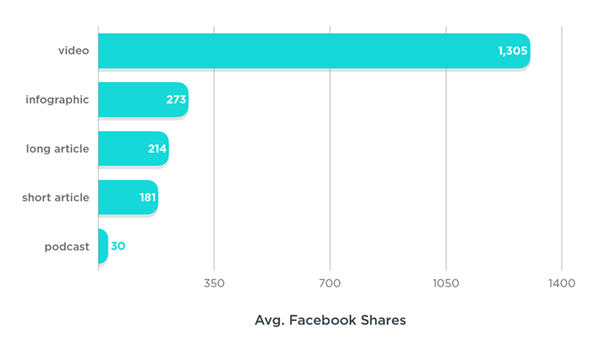

Our industry analysis found that videos and infographics outclassed other content formats in terms of average social shares. In fact, video drove eight times as many shares as articles. Infographics, meanwhile, saw twice as many shares as articles. (We’ll get to social distribution trends in the next section.)

(Note: Our dataset excludes LinkedIn shares, because LinkedIn has closed off their API from all third-party analytics tools.)

Most people working in marketing today understand there’s value in video, but many are hesitant to invest in the medium.

When done well, it’s worth it. Visual content is the most effective way to simplify complex technical information, especially for visual learners. One of the most budget-friendly tactics is to produce short explainer videos optimized for social channels. Mint, for example, launched the WTFinance series a few years ago, breaking down major personal finance concepts in 45-second clips that are easy to digest.

If you get the green light for video, the last thing you want to do is stock your YouTube page with clips of two people talking on stage for an hour. To produce videos that resonate with your audience, pay attention to these three areas.

2. Invest in paid distribution on Facebook

Reports are Facebook’s demise are largely overblown. It still attracts over 2 billion people every month, and remains the most effective social distribution channel for both B2C and B2B content.

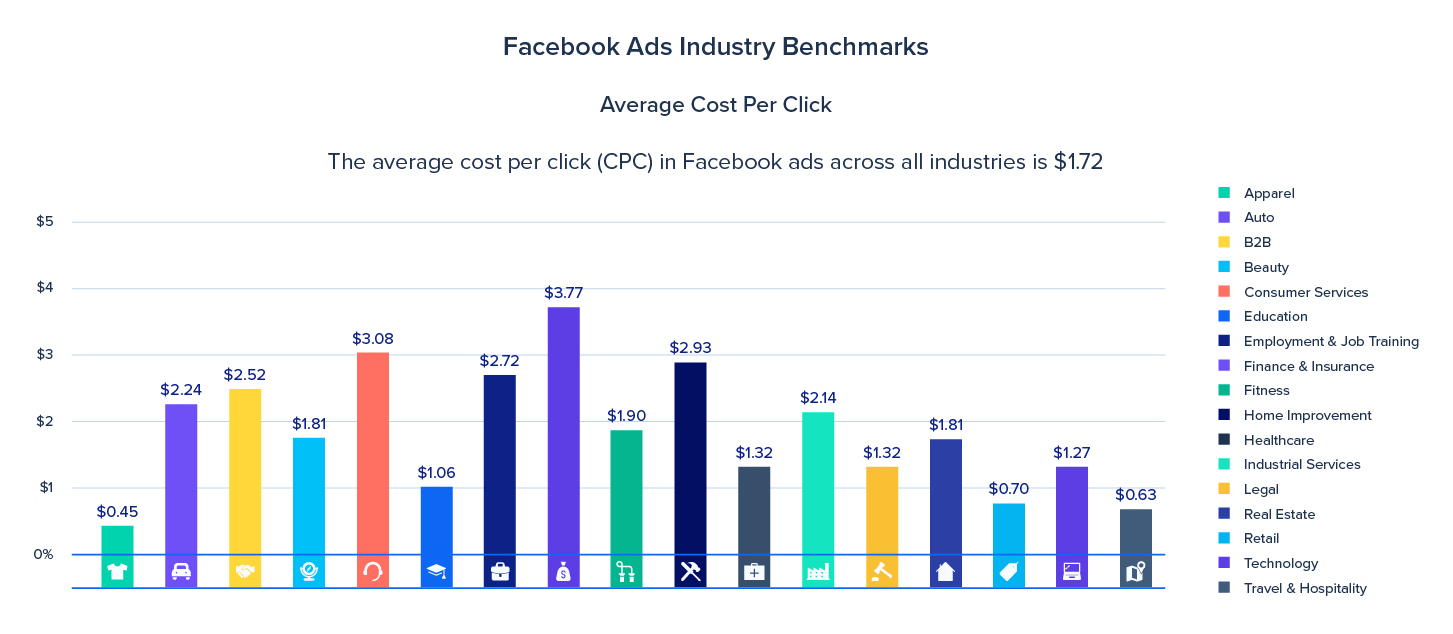

According to Instapage, the average CPC on Facebook for financial services ads is $3.72—more than double the average ($1.72).

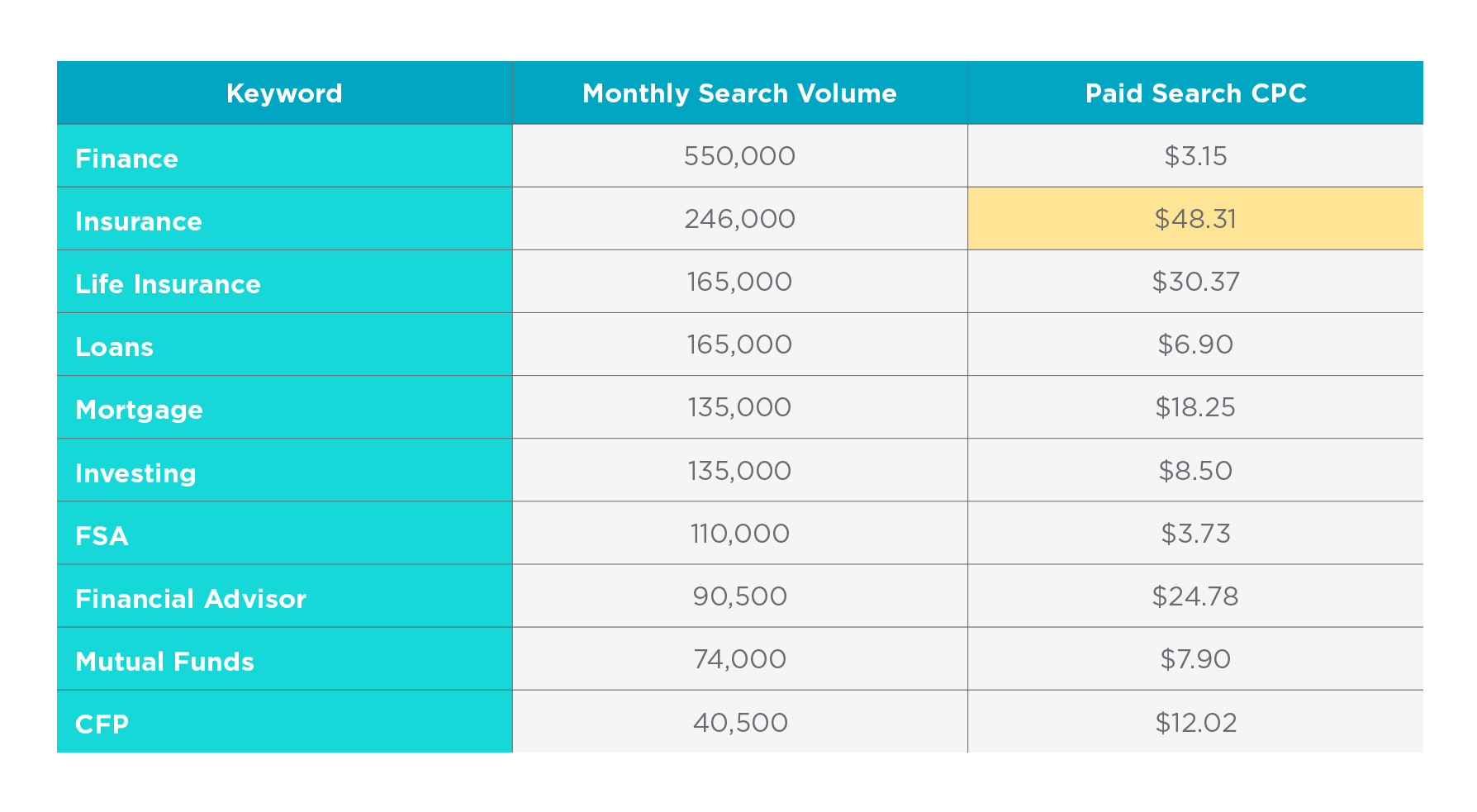

However, this pales in comparison to the CPC on Google for top finserv keywords.

Using SEMRush, we found the average CPC for 10 of the most popular content-adjacent search keywords in financial services for comparison:

Here, we see an average CPC of $16.39 for paid search, meaning Facebook is almost five times cheaper. Not only does referral traffic from social posts help organic search rankings, but you’re also likely to drive additional traffic from the “social lift” of people resharing that content on Facebook.

3. Develop buyer enablement content to drive conversions

When done right, content marketing impacts the entire customer journey. To tie content to revenue, your stories should eventually spark an action—filling out a form, opening an account, signing up for a credit card. In other words, your work assists the customer until they’re ready to make a smart decision related to your company.

We used StoryBook to analyze the most shared content by topic. The most engaging topics—such as reducing risk, insurance 101, and tax planning—tie back to buying decisions. Some news content related to mortgages and insurance also finished near the top of the list.

It’s fitting that content about risk and planning resonated enough for people to share. This kind of advice tends to be practical and applicable to a large audience. State Farm, for instance, drove thousands of shares by packaging together “a collection of articles to help your teen be a safe driver.” The series includes insurance advice for students, info on the costs of certain driving violations, and tips for driving in different conditions. State Farm also includes a calculator tool at the bottom of every article to get a quote, creating a clear path to purchase.

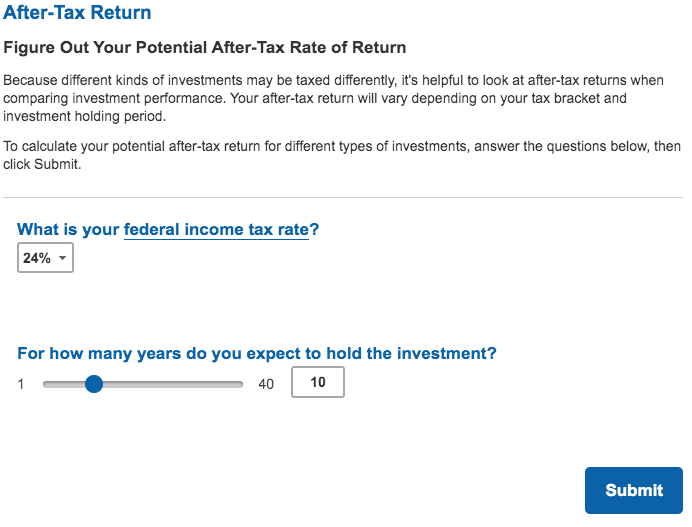

Focusing on enablement content helps brands invest in evergreen financial tools like calculators. These tools empower buyers, letting people navigate a complex decision without explicitly selling to them.

For example, Bank of America built a dedicated page to hold 25 user-friendly tools and calculators that cover retirement, investing, college planning, and personal finance. Creating this kind of content typically doesn’t require a lot of money or time. Take a look at the after-tax return calculator above, which only asks users to fill out two fields before giving them a personalized report.

4. Focus on employee education and advocacy

The success of financial content depends on trust. A blog post full of uniquely insightful 401(k) tips can miss the mark if it doesn’t come from the right source.

The National Foundation for Credit Counseling found that only 25 percent of U.S adults would turn to a bank or credit union if they needed financial guidance, a number on the decline in recent years. However, 35 percent of adults would have no problem trusting a financial planner or accountant.

The same study revealed that 76 percent of U.S. adults said they could “benefit from advice and answers to everyday financial questions from a professional.” The data highlights a sizable gap of people who may not receive the answers they need simply because they don’t trust big financial organizations.

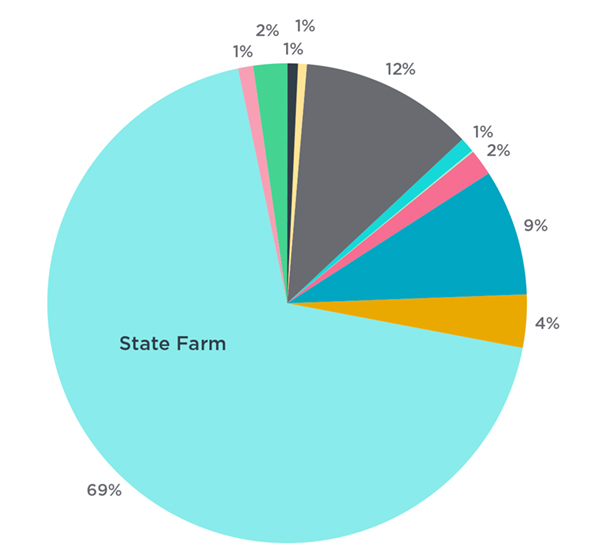

When looking at share of voice results from our research, a related trend caught our eye.

State Farm was dominating in terms of social shares, driving 70 percent of all social shares among 10 companies including Goldman Sachs, Fannie Mae, and Wells Fargo. Did State Farm have some incredible content marketing secret weapon?

It turns out the answer is yes—although when we started to look around, we saw it wasn’t much of a secret. A lot of their social activity was seeded by company’s insurance agents. For most of the last decade, State Farm has used a tool called Hearsay Social to make it easy for thousands of agents to find and post relevant content on Facebook. This system led to a snowball effect for social sharing.

Marketers love to talk about personalization, but their plans fall flat because of logistics. It’s hard to justify spending a lot of money to create content for a specific audience. That’s how finserv companies end up with general listicles meant for a general audience.

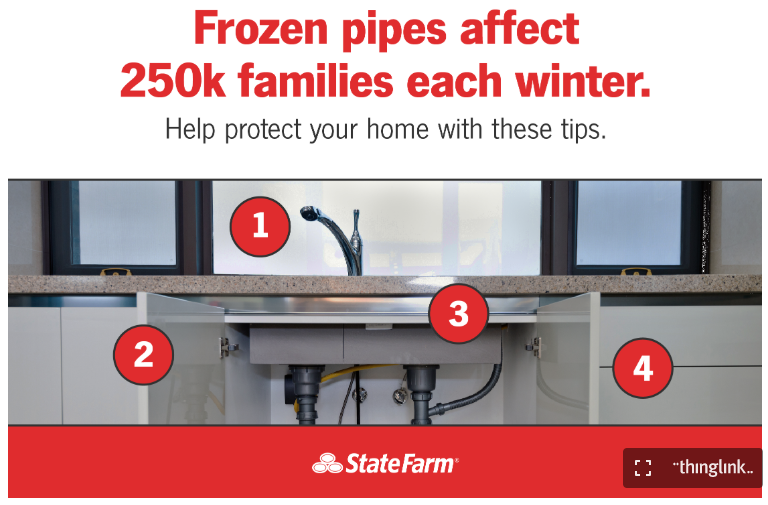

State Farm, meanwhile, incentivized agents to share content by arming them with specific stories that could subtly remind people of the benefits of being insured. According to our research, a short interactive article titled “Frozen Pipe Losses Up in 2018” has generated almost 13,000 Facebook shares.

The article offers clear tips for avoiding frozen pipes and calls out the states with the most frozen pipe water insurance claims. It’s not going to win a Pulitzer, but it’s a helpful piece of content ideal for increasing share of voice.

5. Get creative with compliance

Marketers find few things as grim as compliance. So before we get to the keys of compliance, let’s talk a little bit about death. (Trust me.)

When a famous person passes away, The New York Times can publish a detailed, reported obituary immediately. When Steve Jobs died in 2011, the Times had a 3,500-word article up within an hour. The obituary writers don’t possess other-worldly typing speed; they’re just well prepared. While covering Jobs’s death, for instance, the writing started in 2007. When the time came to let the story go live, all they had to do was give the article a final check.

Mastering the content approval process isn’t as fulfilling as writing an important longform article, but it’s important nonetheless. And with some creative thinking, it doesn’t have to be a headache that gets in the way of your job. You can still publish content at the speed of news.

In highly regulated industries like finance and insurance, you can’t just publish whatever you want, whenever you feel like it. Brands have to deal with oversight groups like the Federal Trade Commission (FTC) and the Financial Industry Regulatory Authority (FINRA). You can, however, work with your compliance team to find reasonable solutions instead of always treating them like a nuisance.

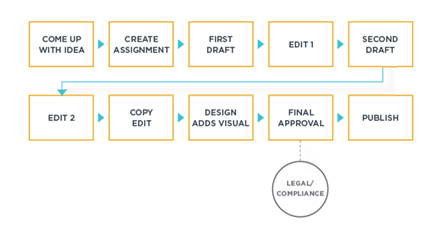

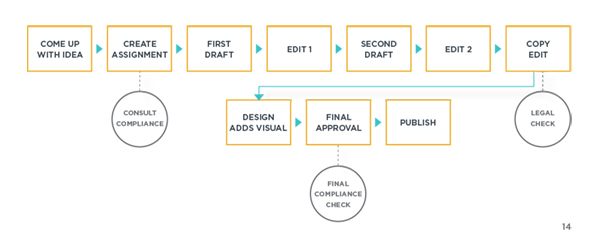

In financial services, savvy companies tweak their workflows to avoid approval timelines that can last upwards of three months. If you meet with compliance at the start of the project, they’ll at least be aware of what you’re working on and can flag potential issues ahead of time.

An adjusted workflow might look something like this:

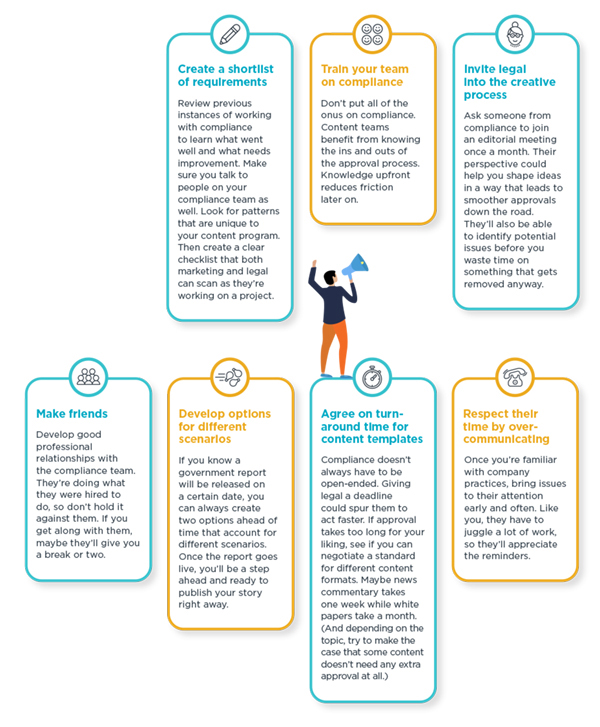

Marketers have started to figure out how to build better relationships with compliance teams. If you’re looking for more efficiency, here are a handful of help exercises that can help you increase productivity.

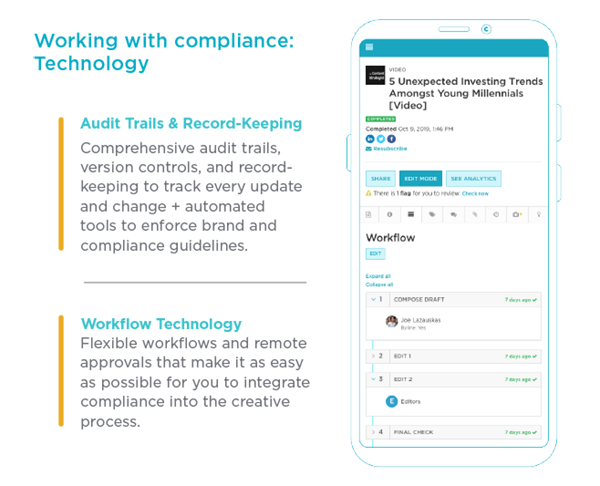

As a final piece of advice, it helps to use some sort technology platform when figuring out compliance. Given that compliance issues often result from a lack of transparency or communication, relying on manual processes doesn’t always work. Technology can handle the logistics, freeing up marketers to focus more on the creative parts of their job. Additionally, it’ll automate certain things like record-keeping, version control, and workflows if you need to review anything down the road.

Conclusion

In 2020, capturing attention is only going to get more competitive in the financial services industry.

The good news is there’s still an opportunity for companies of all sizes to create meaningful content and build long-term relationships with customers. People need financial advice. They crave that expertise. They’re just looking for it to be delivered in a thoughtful way.

The companies that want to stand out and lead the industry need to concentrate on the entire content lifecycle. They have to put as much energy into content distribution, compliance, and sales enablement as they do the creative process. It takes time to build a high-performing content program, but if they put in the work now, their investment will pay off.

If you’re interested in creating high-performing content, click here to set up a free consultation with one of our content experts.

Get better at your job right now.

Read our monthly newsletter to master content marketing. It’s made for marketers, creators, and everyone in between.