Brands

Why Do Insurance Companies Advertise So Much?

How many insurance ad campaigns can you name off the top of your head? Probably a lot.

There’s Mayhem from Allstate, Flo from Progressive, Good Hands, Good Neighbors, Jake and his khakis, Peyton and his parm, Discount Double Checks, Cliff Paul, Generals, Farmers, the Geico Gecko, the Geico Cavemen, and “AFLAC!“—just to name a few.

Most of these campaigns are zany, full of jingles and catchphrases. They tend to be the kind of ads that stick in your head.

Now think about insurance companies. Do you know which brands supply each of your policies? How much is the deductible in your health plan? Everyone should know the answers to these questions. Yet according to a 2016 survey by PolicyGenius, half the country still can’t define a deductible.

Insurance is a competitive space, which is why companies create talking ducks to get our attention and cut through the clutter. But a desire to improve recall is only part of why there’s so much insurance content out there.

From low involvement to top-of-mind

“Let’s face it,” said Matt Johnson, State Farm’s former head of digital marketing. “Insurance is not a high-interest category for someone aged eighteen to thirty-five. They want to spend as little time as possible thinking about insurance.”

Insurance isn’t a fun product—millennials aren’t arguing whether Allstate or Progressive is cooler the way they would for Nike and Adidas. It’s also a low-involvement product, one continually paid for without much consideration by the consumer. As long as nothing goes wrong, retention rates are high.

“The goal is to create engagement,” Johnson said. “You are battling for share of the mind of this human being. For something like insurance, these people don’t know that they’re going to [need it]. So when that happens, they’re going to research two or three companies. We need to be top of mind.”

It’s why Geico will never stop reminding you that “15 minutes could save you 15 percent or more on your car insurance.” Think of HeadOn, the seemingly magical chap stick that claimed to cure headaches. The ads, consisting almost entirely of the phrase “HeadOn, apply directly to the forehead,” were undeniably annoying. The product was proven to be no more effective than a placebo. And yet HeadOn sales rose 234 percent from 2005 to 2006.

Not surprisingly, insurance companies love jingles for the same reason. Take the long-running “Nationwide is on your side” jingle, which took on new life when NFL superstar Peyton Manning got involved in 2014.

Fans began filming their own parodies, often playing with Manning’s “Chicken parm you taste so good” line. Nationwide made sure to take advantage of its newly viral content, developing special social campaigns around the work and even giving out free chicken parms before one of Manning’s Denver Broncos home games.

From a strategy perspective, the ad can be summarized by the following: Show the jingle stuck in Peyton’s head, and hopefully it’ll get stuck in the audience’s as well. Then, those people will think Nationwide when they need insurance.

It’s a really simple concept that proved to be successful. Nationwide achieved $42.9 billion in total sales across all product lines in 2015, an increase of more than $3 billion from the previous year. While it’s impossible to directly attribute those sales to a single campaign, former SVP of marketing Jennifer Hanley said that “from a paid-media perspective, it’s one of our single most effective ads ever.”

The commercial generated over 20 million “organic impressions” from people sharing the content on Facebook and Twitter, multiples of what company ads typically saw. Even though Manning has since retired, the campaign is still going strong in its third season.

Big budgets mean big campaigns

The American insurance marketplace is the largest of its kind worldwide. According to the Treasury Department’s 2016 industry report, U.S. carriers collected over $1.27 trillion in premiums in 2015, a 15 percent increase over 2009. This figure equates to about 7 percent of domestic GDP.

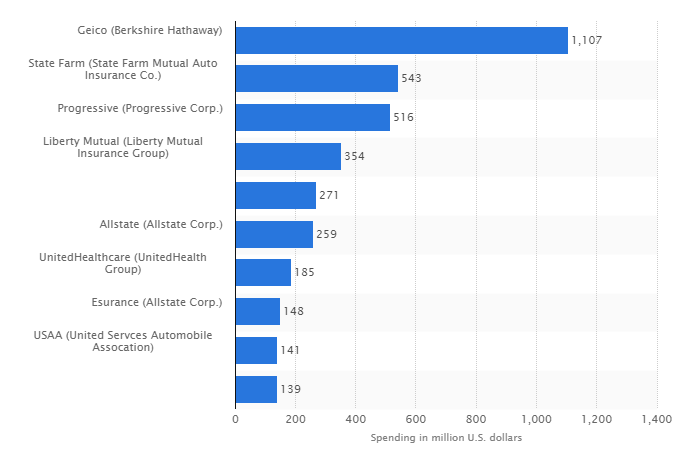

These lofty numbers make sense. Insurance is one of the few products nearly everyone owns in some form (and in many cases is legally required). In order for industry players to gain market share at the expense of rivals, their high revenues translate into massive advertising budgets. Below are the media spend totals for selected brands in 2015:

Take Geico, whose yearly ad budget surpassed $1.1 billion. (Insurance had the third-highest media spend of any category during 2016 NFL season.) Geico doubled the spend of the next-closest brand, but that seems to have been a wise investment. Premium income increased 11.2 percent in 2013, the first year Geico passed Allstate to become the second-largest auto insurance provider.

The massive budget allows for the company to push out multiple campaigns at the same time, which is crucial in such a competitive category. For a company like Geico, which doesn’t have a brick-and-mortar presence, the advertising excess helps counteract missed opportunities. The ad director at State Farm once joked Geico was running 28 campaigns simultaneously.

Beyond Geico, it benefits the insurance industry as a whole to turn its hefty profits into advertising. A 2016 study by Velocify surveying over 1,000 insurance agencies found that those who spend at least 15 percent of their revenue on marketing are more likely to see “significant revenue growth” of at least 20 percent year over year. Brands that spend less than 5 percent, on the other hand, are three times as likely to see zero growth.

When consumers are pressed to make a less interesting purchase decision, they’ll end up going for what’s easiest, not necessarily what’s best. It pays to be the first brand they think of, and insurance companies have plenty of money to spend on that privilege. So don’t expect the profusion of insurance advertising to go anywhere any time soon.

Image by CC ZeroGet better at your job right now.

Read our monthly newsletter to master content marketing. It’s made for marketers, creators, and everyone in between.