Digital Transformation

Marketers and Media Companies Are Arriving at an Eerily Similar Business Model

I recently sat in on a panel at the International Journalism Festival in Perugia, Italy, listening to journalists talk about their marketing stacks. Maybe it was the jetlag, but I felt like I was in bizarro world. Normally, I spend my time at content marketing conferences listening to marketers talk about adopting journalism principles. Instead, here I was, listening to journalists talk about their marketing strategies.

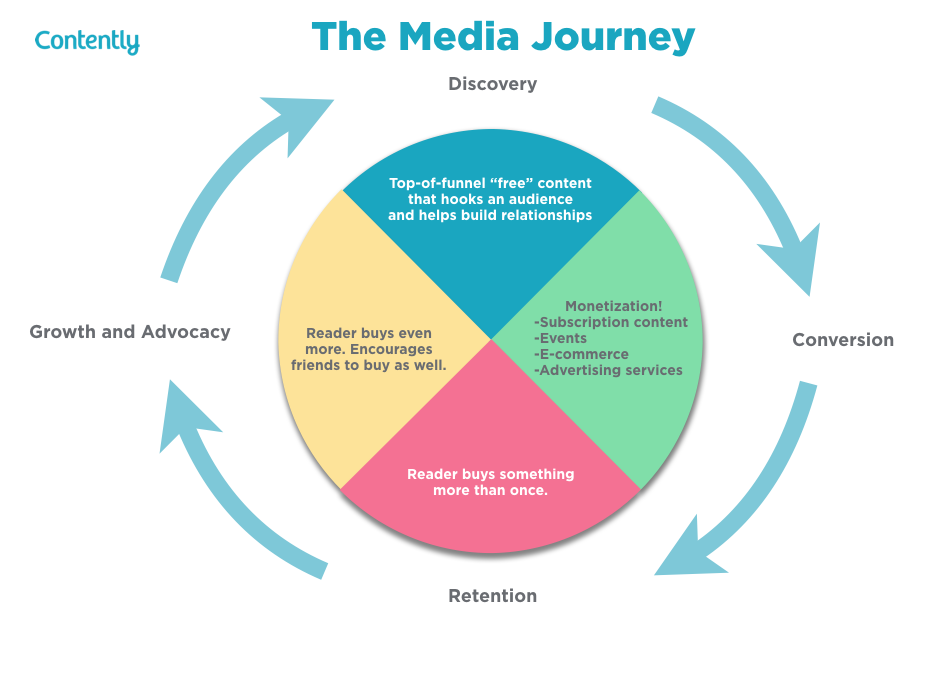

This is a slide you’d normally see at a demand generation session—except there’d normally be 27 more completely unnecessary arrows and boxes, and the terms “synergy,” “value-based,” and “co-creation” thrown in at random.

The slide was presented by Mary Brown, CEO and founder of The Hub, an initiative that helps news orgs productize their content and drive memberships. The Hub is riding the wave of a larger paradigm shift in the media industry, moving away from the perception that content is a pageview vessel for delivering advertising. Instead, it’s trying to be a “top-of-funnel” marketing tool for building relationships with people and getting them to pay directly for subscription content, events, advertising services, or some other product.

If that sounds a lot like content marketing, that’s because it is. Funny enough, marketers and media companies are now arriving at an eerily similar marketing model.

The Facebook effect

Hot take: Facebook tanking publishers in its algorithm earlier this year may be the best thing to ever happen to media companies. Why? Because it made them realize something important: the page view rat race isn’t winnable.

“Most publishers abandoned reader revenue and thought they’d build revenue on scale, and thought things would be great,” Raju Narisetti, CEO of Gizmodo Media Group, explained on an IJF panel. “But it hasn’t been great.”

The first half of this decade, VC money flowed into digital media companies like BuzzFeed, Mashable, and Vice. To satisfy investors, those companies chased traffic at any cost, with the assumption that if you had the most unique visitors, you could build the strongest business—eventually.

But over the past few years, as knockoff competitors battled for reader attention and Facebook’s algorithm changes gradually shut off the flow of clicks, publishers have struggled to grow—or even maintain—their raw traffic numbers. As a result, those publishers came to a realization: The best way to make money is to build relationships with a smaller group of readers, who are then willing to buy something.

There’s no “right” revenue stream.

For publishers like the ones in The Hub, that “something” people buy is a membership that grants access paywalled content. Clicks and free content are merely a way to get people into the marketing funnel until they’re hooked and convert. This model is working out well for legacy publishers like The New York Times and The Financial Times. Subscriptions surpassed $1 billion at The Times late last year, making up 60 percent of all revenue.

According to Renee Kaplan, head of audience engagement at the Financial Times, subscription revenue now makes up 60 percent of its revenue as well. For FT, the focus isn’t on growing its traffic—it’s deepening those relationships with readers. “The model was about how to reach more people at the top of the funnel,” Kaplan said. “We’re now moving toward getting readers who are already paying for content to continue paying for content and pay more for content.”

In turn, FT treats its content like a product. It created a paywalled hub about deal-making called Due Diligence, for instance, because research indicated it was something people would pay for. Events for members let them monetize even further.

More than paywalls

Gizmodo Media Group—the Univision subsidiary that owns the castoff Gawker sites, as well as The AV Club and The Onion—doesn’t use a paywall. But it still follows a similar model of monetizing readers.

According to Narisetti, Gizmodo’s CEO, half of the company’s revenue comes outside of traditional digital advertising like display and programmatic. The biggest “non-advertising” channel is e-commerce.

Subscriptions don’t make as much sense for Gizmodo Media Group, because there are “ten other publishers” that cover the same stories as its tech, sports, and lifestyle sites. The edge comes from the irreverent, funny voices that attract a loyal following.

E-commerce revenue comes via affiliate links packaged into article and newsletter products like Kinja Deals, which runs across Gizmodo sites. Trust here is key, according to Narisetti. If a someone only has $100 to buy an exercise bike, we’ll say, ‘These two suck, but this one’s okay,’ and people think, ‘I like these guys, I trust them.'”

Leaders like Kaplan and Narisetti agree that there’s no “right” revenue stream for media companies. You need multiple income sources across content, advertising, events, and e-commerce. But to survive and thrive, you need to adopt the age-old marketing model: Build strong relationships with people, and then get them to keep spending money with you.

Image by iStockPhotoGet better at your job right now.

Read our monthly newsletter to master content marketing. It’s made for marketers, creators, and everyone in between.