Trending

Report: Only 14 Percent of Financial Companies Consider Themselves ‘Innovation Leaders’

When I paid rent for my apartment last month, my landlord said: “Adam, you can just Venmo me.” When I asked why, he simply mentioned that it was more convenient to just use his phone rather than going to the bank.

The request made sense, but the moment was still a little perplexing. I never thought I would pay my rent the same way I pay my friends to split dinner. As someone who recently graduated college and is surrounded by friends worrying about their loans, I’m starting to see the evolution of banking and finance everywhere I turn.

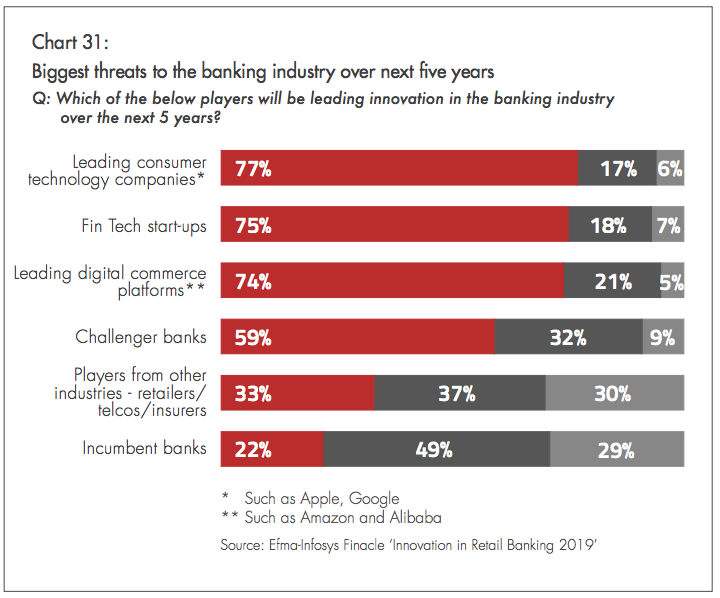

On that front, Efma and Infosys Finacle partnered on a detailed 2019 report that explores digital innovation leaders in retail banking. A big takeaway from the report was that a wave of new competitors (like Venmo) are starting to pose a threat to legacy companies in the financial sector. Banks are aware of the changes and expect many of these challengers to “be leading innovation in the banking industry.”

This shift is taking place for a few key reasons. Non-traditional competitors have figured out how to use technology and data to improve customer service. Just think back to my Venmo example, which highlights the need for better customer experience in banking.

Some companies are building trust and retaining customer loyalty by creating useful content like budgeting templates and savings calculators. The most creative brands in the industry have developed engaged audiences by expanding outside of strictly financial content. Money overlaps with all areas of life, so companies that tie core topics to angles around entertainment, health, sports, and more are building lasting relationships with customers.

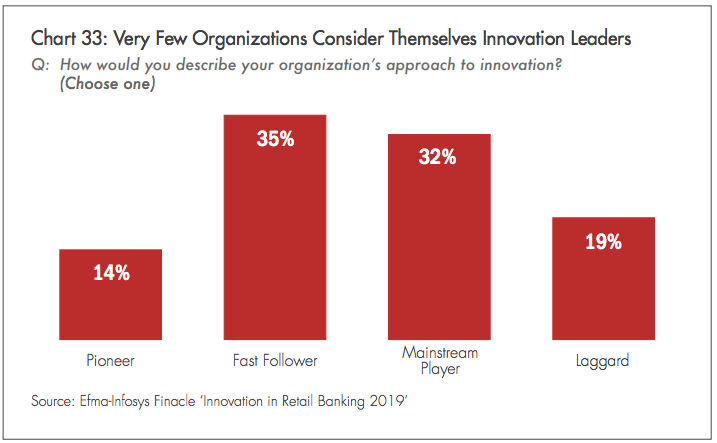

Traditional financial services companies have the expertise and resources to step up and compete. To their credit, some are. The chart above shows that 14 percent of these companies consider themselves innovation leaders in the industry. But for most banks, they’re somewhere in the middle, only eager to change when they see a new approach start to work.

Remember that creating a sleek app or publishing cool content is not enough on its own. The financial services companies that ultimately become pioneers will serve customers accessible resources and information that educates and entertains. That’s true whether you’re trying to reach landlords, people with student debt, retirees, or anybody in between.

Get better at your job right now.

Read our monthly newsletter to master content marketing. It’s made for marketers, creators, and everyone in between.