Brands

Facebook and Google Rule Advertising, and 3 Other Takeaways From the IAB’s Latest Report

Last week, Facebook announced that it had reached 1 billion mobile-only monthly users. Meanwhile, October was the first month when mobile and tablet devices accounted for more pageviews than desktops, according to analytics firm StatCounter.

Both highlights signal the culmination of a trend that has been simmering for a while now: Mobile devices have taken over media consumption.

There’s only so much time in a day, and mobile’s growth has come at the expense of other formats. Per eMarketer, time spent with every medium—including advertising giants like TV, radio, and print—has been colonized by mobile devices.

The Interactive Advertising Bureau’s (IAB) latest revenue report, released on November 1, shows that advertisers are finally catching up to these trends. Here’s how.

1. Mobile ad spend is booming

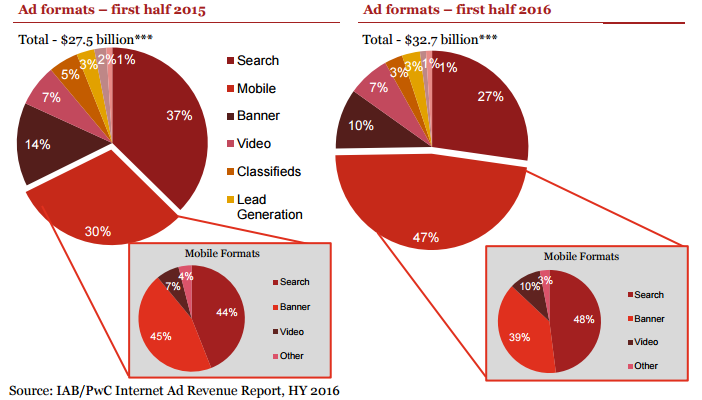

In just a year, spending on mobile advertising in the U.S. climbed 89 percent to $15.5 billion, accounting for nearly half of digital ad budgets. In the process, it bypassed search as the digital format that accounts for the most ad spend.

However, it’s important to note that search and banner ads are still thriving during the mobile boom. Most of the mobile revenue (87 percent) consists of search and banner investments. Additionally, the report found that 47 percent of all search and display revenue now comes via mobile, up 17 percent from 2015.

2. Social ad spend is on the rise as well

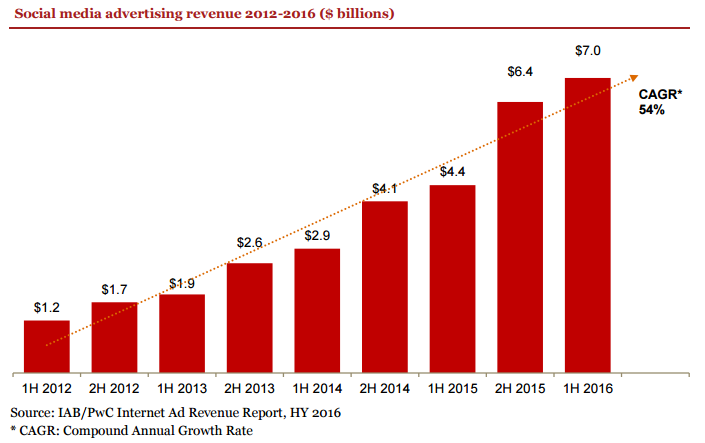

As mobile spend has grown, so, too, has social media revenue. Social media ad revenue is up 57 percent from the same time period last year, continuing its consistent upward trend since the IAB first began measuring the variable back in 2012.

While people spend much more time watching digital video on desktop devices, social networks account for a much higher timeshare on mobile. A lot of this activity comes from apps like Facebook, Twitter, and Snapchat, which account for the vast majority of time spent. In other words, users are going through apps instead of mobile web browsers.

Perhaps because of these trends, Facebook, Instagram, and Snapchat have all released new advertising tools—better targeting, more sophisticated formats, easy-to-use APIs—that make their ad efforts more efficient and effective.

3. Advertisers are buying into the digital video hype

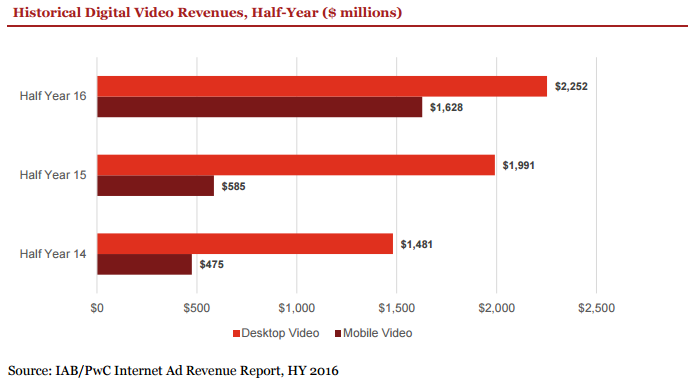

Mobile video experienced a modest 23 percent growth over the first half of 2015 compared to the same period in 2014. But in the first six months of 2016, digital video revenue on smartphones and tablets exploded to $1.6 billion, an impressive 178 percent growth over the previous year.

Digital video is also the only format still achieving meaningful growth on desktops, rising 13 percent in revenue from 2015.

This rapid increase in spending can be tied to social media. According to research by Advertiser Perceptions on behalf of Trusted Media Brands, “65% of media executives say social media is the most important platform for digital video advertising.”

4. Almost all the gains are going to Facebook and Google

The two tech giants accounted for 85 cents of every new dollar spent on U.S. digital advertising over Q1 2016, per Morgan Stanley, and the IAB’s report underscores that dominance.

When you compare the domestic ad revenues of Google and Facebook against the rest of the industry, the lack of parity is astonishing. Everyone else combined for a 3 percent loss.

.@iab it does seem relevant to note when you back out Facebook and Google, the digital ad industry actually shrunk in 1st half. #unhealthy pic.twitter.com/x0gRXWz6XT

— Jason Kint (@jason_kint) November 1, 2016

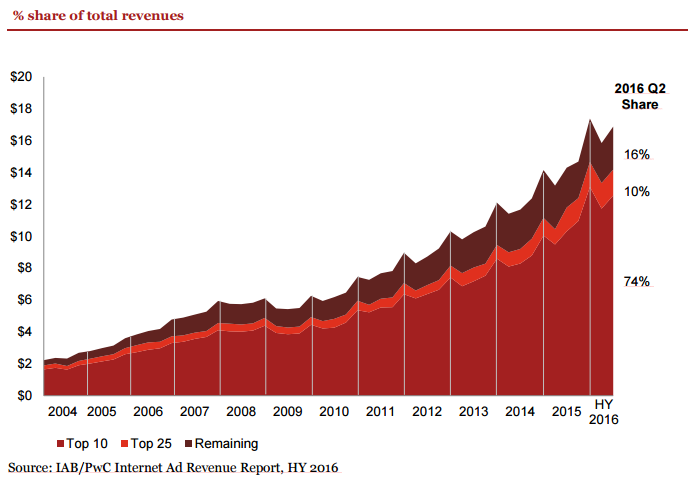

In total, the top 10 ad-selling companies accounted for 74 percent of total online revenue in Q2 2016, a slight increase over the same period last year. Companies ranked between 11th and 25th generated just 10 percent of Q2 revenue.

It comes as no surprise, then, that the rest of the media sector is probing competitors of Google and Facebook to lessen the duopoly’s impact. “We need more balance in the marketplace to counter the growing force of Facebook and Google,” Sir Martin Sorrell, CEO of advertising group WPP, told The Financial Times.

Microsoft did its part with its recent $26.2 billion purchase of LinkedIn, while Verizon is still working out the details of its agreement to buy Yahoo, a deal that may be in flux after Yahoo’s massive September data breach.

Regardless of the moves, one thing is for certain: As mobile, social, and video ad revenue continues to surge, Facebook and Google will only get stronger.

Image by Petar Chernaev / GettyGet better at your job right now.

Read our monthly newsletter to master content marketing. It’s made for marketers, creators, and everyone in between.