Media

Over 70 Percent of Native Ads Get a Failing Grade

News publishers are flunking their disclosure tests, and they may be killing native advertising in the process.

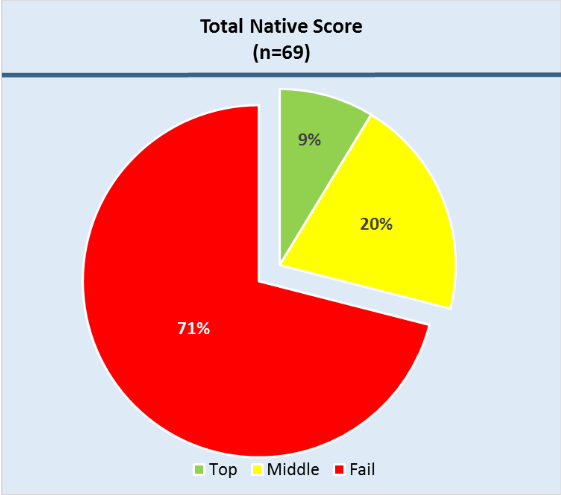

In a new study released today by the Online Trust Alliance (OTA), a nonprofit whose mission is “to enhance online trust and empower users,” 71 percent of the top 100 news publishers received a failing grade when it came to disclosing and delineating their native advertising.

The results come during a pivotal time for the digital advertising industry and the publishers that run their ads.

Ad blocking continues to grow on both desktop and mobile. According to PageFair, a company that provides anti-ad-blocking services, about one in five smartphone users employ an ad blocker, which constitutes a 90 percent increase from last year. The Interactive Advertising Bureau (IAB), meanwhile, recently found that 26 percent of U.S. internet users employ ad blockers and 17 percent are “at risk” to begin using them. And trust in the media is perilously low: Only 6 percent of Americans say they have “a lot of confidence in the media,” according to a study by the Media Insight Project.

The OTA’s study was conducted in April 2016, about four months after the Federal Trade Commission (FTC) released an updated guide for native advertising. In the guide, the FTC emphasized the importance of consistent disclosure tags like “Ad,” “Advertisement,” “Paid Advertisement,” or “Sponsored Advertising Content,” while also taking aim at more ambiguous but commonly used tags like “Promoted Content” or “Partner Content.” The guidelines also stressed the use of signifiers—different font colors, shading, audio disclosures—to delineate sponsored content from editorial content.

Of the 100 news sites the OTA examined, 69 percent had some form of native advertising, which the organization defined as “content that is funded and produced outside the publisher’s editorial review or influence, yet is designed to appear similar or homogenous to editorial.”

The study then gave a score for each native ad, using the FTC guidelines and previous studies as background. Up to 10 points could be given, based on three weighted factors: disclosure terminology (60 percent), visibility and readability (30 percent), and delineation from the rest of the page (10 percent).

The results were discouraging: Only 9 percent received a score of 80 percent or better, and 71 percent received a score of 55 percent or lower. In the opinion of the OTA, the result is a lose-lose-lose situation. Consumers are deceived, publishers erode already damaged consumer trust, and advertisers lose more users to ad blockers.

“While native ads without proper disclosures may yield short term monetary goals, they risk marginalizing the long-term value of advertising and the reputation of sites where they are served,” Craig Spiezle, the OTA’s executive director, said in a press release. “Consumers who experience annoyance, confusion, and misinterpretation in native advertising, combined with increasing security and privacy issues will likely turn to using ad blockers. The result is nobody wins.”

The OTA also pointed to the tension at the heart of native advertising. Native advertising is defined as advertising camouflaged as editorial content, yet at the same time the form requires clear delineation in order to not confuse consumers. It’s a contradiction that publishers have a difficult time reconciling.

But that doesn’t mean that native advertising is dying, at least not on the internet as a whole. A recent BI Intelligence study estimated that native ads will make up 76 percent of all ad revenue by 2021, up from 56 percent this year. That study, however, defines native advertising as any display ad that “take on the look and feel of the content surrounding them.” In other words, social media advertising such as in-feed ads on Facebook and Twitter count as native advertising. Not surprisingly, those social giants drive the majority of the estimated growth in the practice.

For publishers, the future of native advertising seems far more grim.

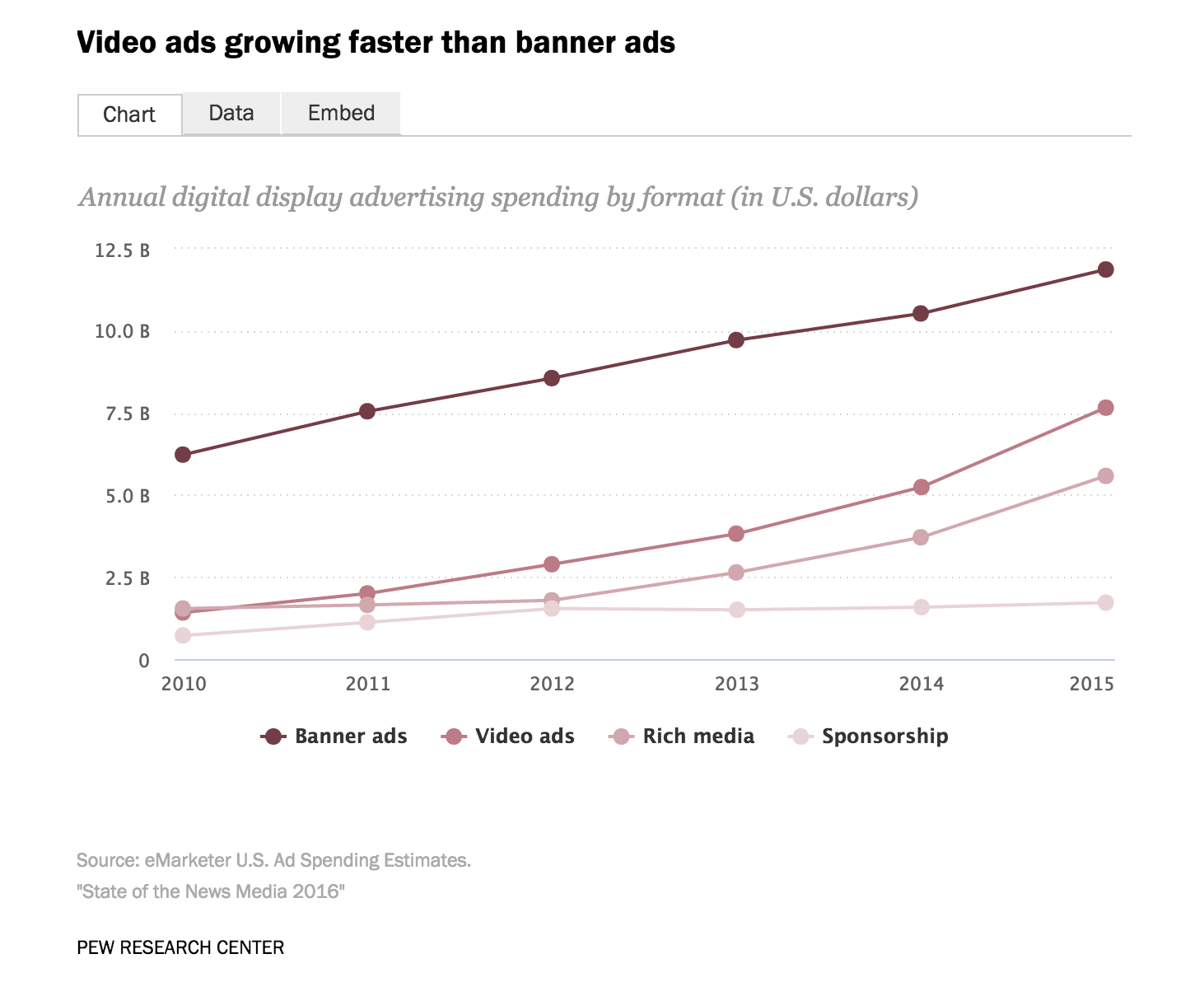

Pew Research’s 2016 “State of the Media” study estimated that “sponsorship” ads—defined the same way as native advertising—have almost completely stagnated as a source of revenue for publishers.

It’s a big reason why publishers’ native advertising studios are increasingly expanding into full-service creative agencies, such as The New York Times’s T Brand Studio and The Financial Times’s FT Squared.

Native ads, at least the kind created and run on publisher sites, appear to be floundering. That’s just one of many problems the advertising and media industries are tackling in a time of declining revenue and duopoly-level industry domination by Facebook and Google. And the OTA’s report is only the latest in a line of statistics that doesn’t inspire confidence that those problems will be solved anytime soon.

Image by Getty ImagesGet better at your job right now.

Read our monthly newsletter to master content marketing. It’s made for marketers, creators, and everyone in between.