Social

The State of Messaging Apps, in 5 Charts

Social media and texting are so 2010. Here in 2015, digital communication is all about the messaging app.

An increasing number of people are migrating from highly public social media networks like Facebook to private micronetworks for their to day-to-day communication. They’re also starting to abandon traditional carried-based SMS and MMS texting for these free (or very cheap) services such as Facebook Messenger, WhatsApp (which is owned by Facebook), Snapchat, Viber, WeChat, and a seemingly endless supply of challengers.

Here in the United States, the movement to messenger apps has been relatively slow—but in markets like Asia, Europe, and India, the apps have become inescapable, and are only continuing to grow. Make no mistake: Messaging apps are just getting started.

Just this month, Facebook announced that Facebook Messenger would be spun off as a standalone app, while Twitter entered the race in its own way by eliminating the 140-character limit for Direct Messages. When two of the biggest traditional social networks are making such bold moves, that means it’s probably time to pay attention.

Others may be scrambling to get a handle on the rapidly changing space, but don’t worry, we’ve got you covered. Here are five of the most insightful and illustrative charts for anyone hoping to understand just how important messaging apps are to the future of communication.

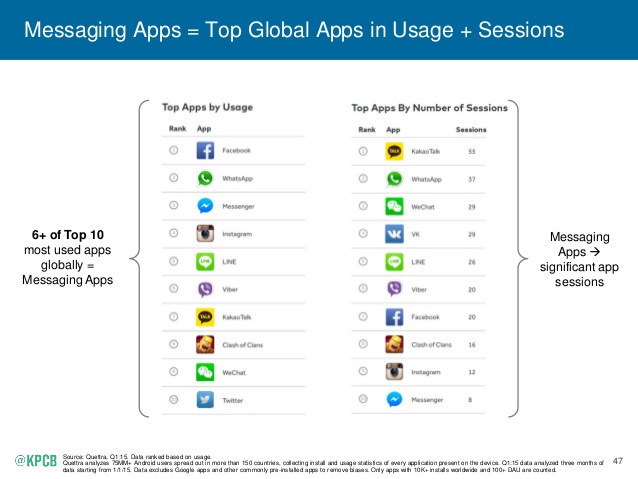

1. Messaging apps dominate mobile usage and sessions

Source: KPCB

Mary Meeker’s recent Internet trends report took a close look at the rise of messaging apps, and for good reason. As you can see from the slide above, messaging apps dominate both usage and numbers of sessions. The two metrics are important signifiers for tech companies that want to keep audience attention for as long as possible and bring in potential advertising dollars.

It’s worth noting that the four top apps by usage are all owned by Facebook, which has been aggressively expanding in the chat app ecosystem. Readers should also consider KakaoTalk, WeChat, and LINE’s higher rankings for sessions; all three apps offer extensive services within the app, and, as you’ll see below, are dominant in their respective countries. Not surprisingly, Facebook is hoping to convert its Messenger to more closely resemble these apps at the top of the sessions leaderboard.

2. Messaging apps are growing exponentially

Source: TechInAsia and Statsy

Practically every major messaging app has seen big-time growth over the past two years. WhatsApp, in particular, has exploded, thanks in large part to an influx of users in developing countries like India, Mexico, and Brazil. The company also credit its success to a clear focus on the core messaging product and a decision to avoid any advertising on the app.

Overall, it’s an interesting strategy for WhatsApp. The lack of monetization has meant ridiculous growth, but the company’s revenue pales in comparison to some smaller competitors. Mark Zuckerberg is on record as saying, “Products don’t really get that interesting to turn into businesses until they have about 1 billion people using them,” so it’s likely that Facebook is simply biding its time while the WhatsApp user base continues to grow.

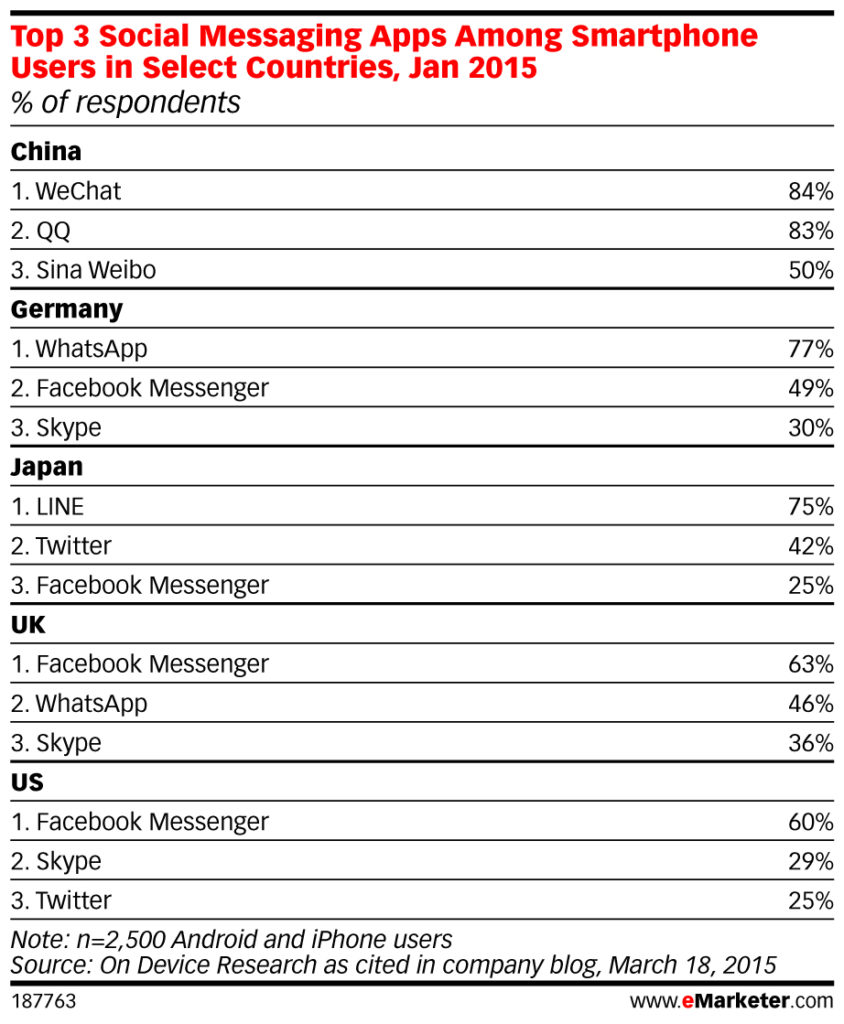

3. Messaging app preferences differ by region

Source: eMarketer

It shouldn’t come as too much of a surprise that messaging apps still have largely segregated user bases. Facebook is pretty much the only platform that has come close to true global reach, and most messaging apps haven’t been around long enough to realistically reach similar numbers.

What’s not shown in this chart is India, the second most populous country in the world, which touts 70 million users as of November 2014. That number has likely increased considerably since the total user base for WhatsApp has grown from 600 million to 800 million in less than a year. Other developing nations like Mexico and Brazil also tend to favor WhatsApp, as does much of Western Europe.

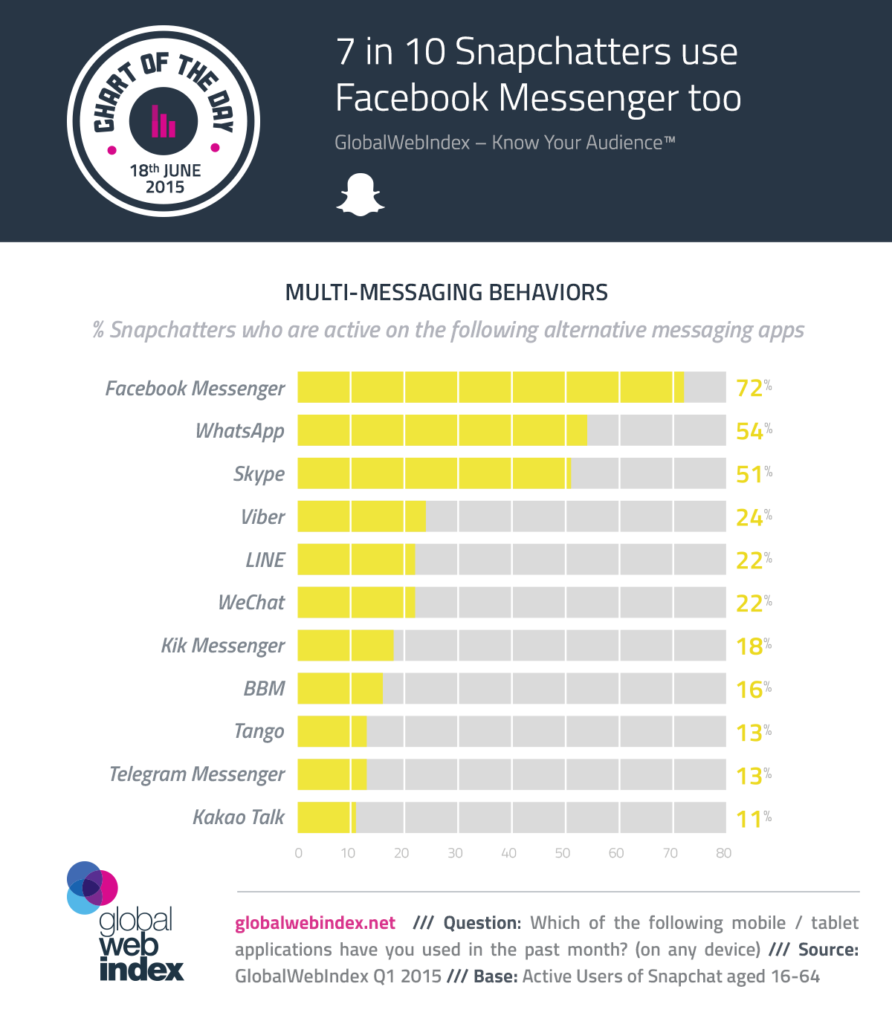

4. Users aren’t necessarily exclusive

Source: GlobalWebIndex

It would be a mistake to make assumptions about global usage tendencies based on one graph, but, at least with Snapchat, users tend not stick to with one messaging platform.

In countries where certain apps are more dominant, such as China and Japan (Snapchat is actually banned in China), it’s likely that these numbers aren’t nearly as high. But in countries like America where Snapchat is more popular, it’s clear that one app isn’t enough for most users. In other words, there is still room for multiple players.

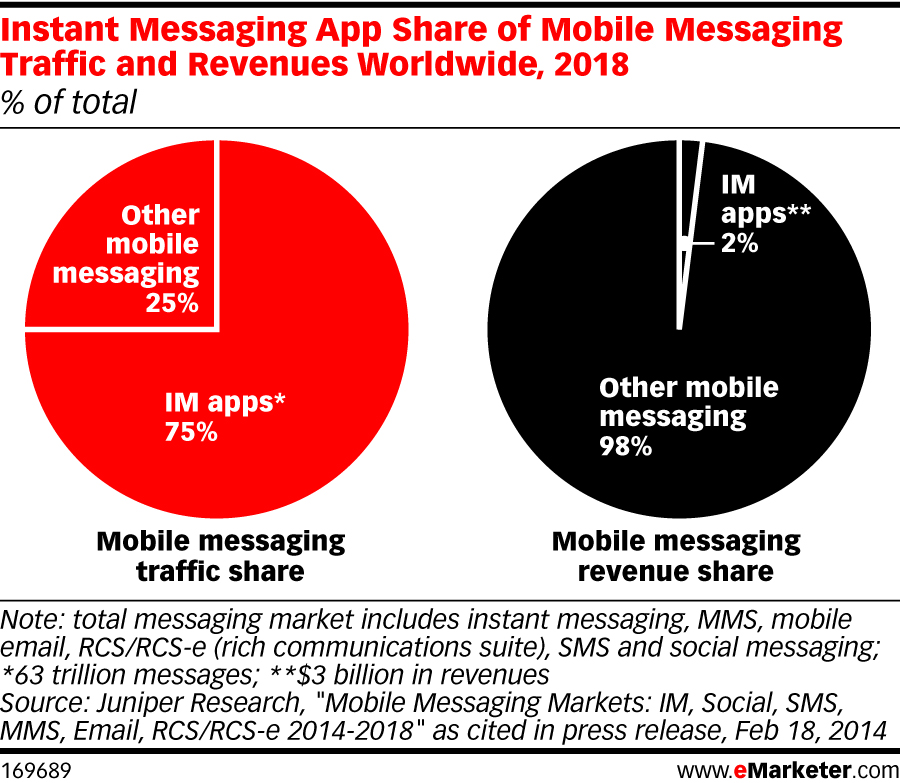

5. Mobile carriers are being replaced, but revenue is an issue

Source: eMarketer

This graph is slightly confusing, so let’s break it down a bit. Here, “IM apps” are what we’ve been discussing: free or mostly free messaging apps that skirt carrier plans. “Other” mostly consists of SMS and MMS messaging from carriers.

As you can see, Juniper Research estimates that messaging apps will come to dominate the mobile messaging traffic share at the expense of carriers. However, what’s interesting is Portio Research’s estimations have global messaging apps’ revenue peaking at $239.7 billion this year and declining from there.

This research flies in the face of the high valuations and investment rounds many of these apps are receiving.

The monetization challenge is real, but a few contenders have blazed a trail. Kik, for example, uses branded bots, while the Asian apps have demonstrated that features like car services, game marketplaces, and food delivery can drive legitimate revenue.

WhatsApp’s relatively small revenue is perhaps the best evidence that supports why this chart’s estimates are so grim, but it’ll be worth watching what happens if Facebook begins to monetize WhatsApp once it passes 1 billion users. Zuckerberg and company may just prove these researchers wrong.

Image by RazihusinGet better at your job right now.

Read our monthly newsletter to master content marketing. It’s made for marketers, creators, and everyone in between.